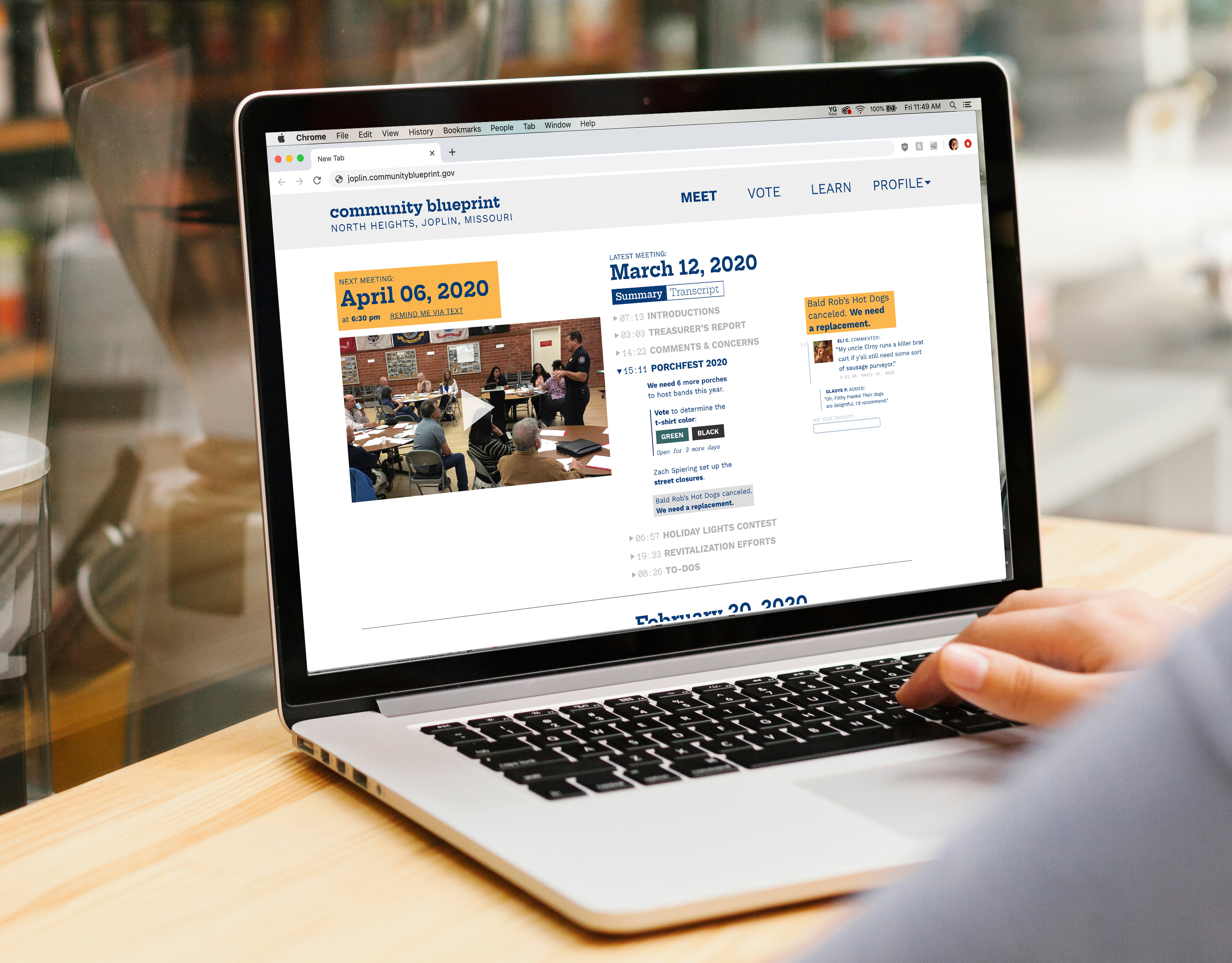

I made this social media explainer for my third project with Reimagine Arkansas, a project by the Winthrop Rockefeller Foundation dedicated to amplifying the voices of those most harshly impacted by the COVID-19 pandemic.

DISCIPLINES

Illustration, data visualization, social media

TOOLS

Adobe Illustrator

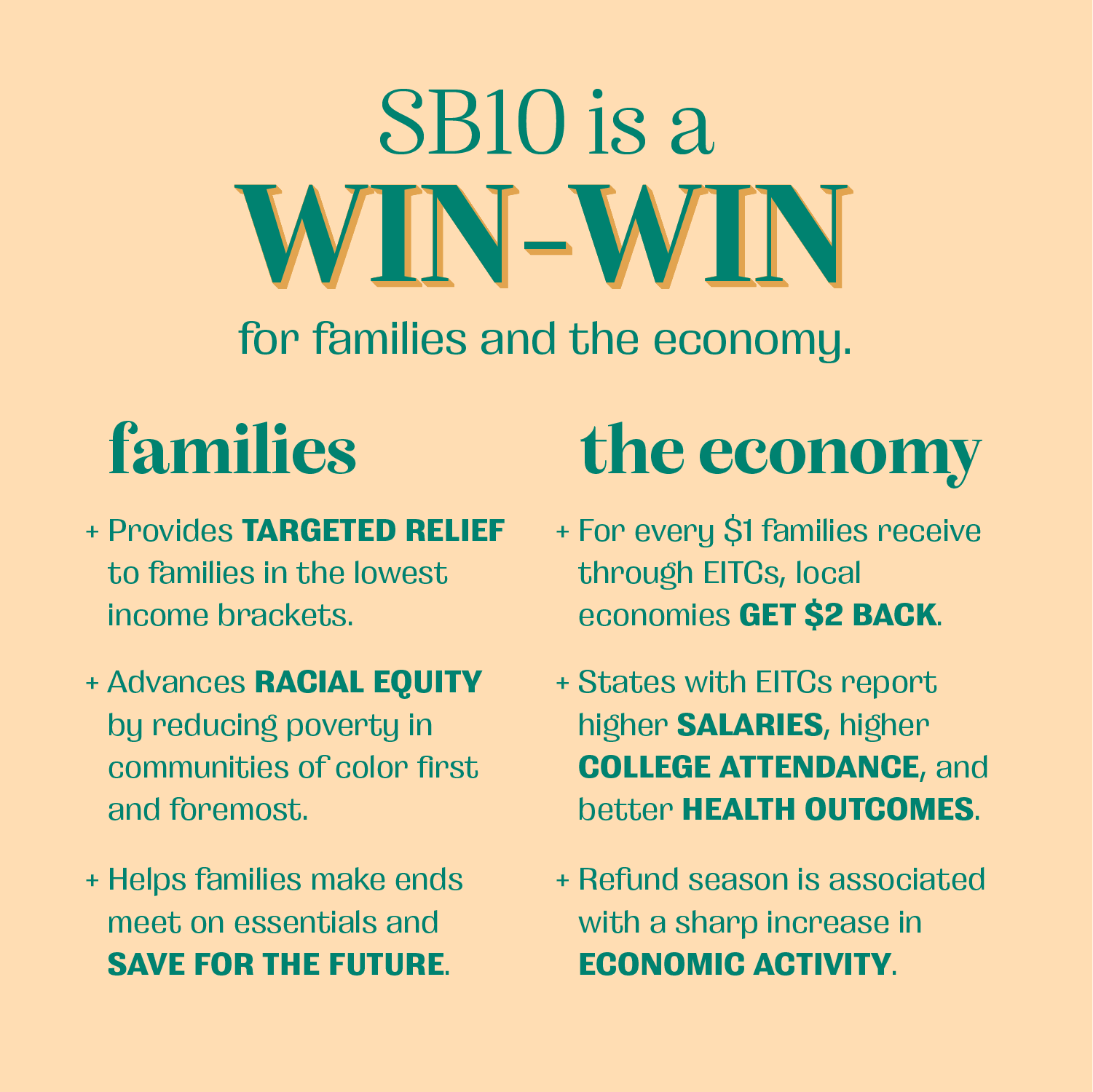

ASK YOUR ARKANSAS STATE LEGISLATORS TO PASS SB10!

Senate Bill 10, or the Working Taxpayer Relief Act, would create an Earned Income Tax Credit (EITC) in the state of Arkansas. State EITCs are an important tool for combatting poverty and helping working-class families make ends meet on rent, food, healthcare, and childcare.

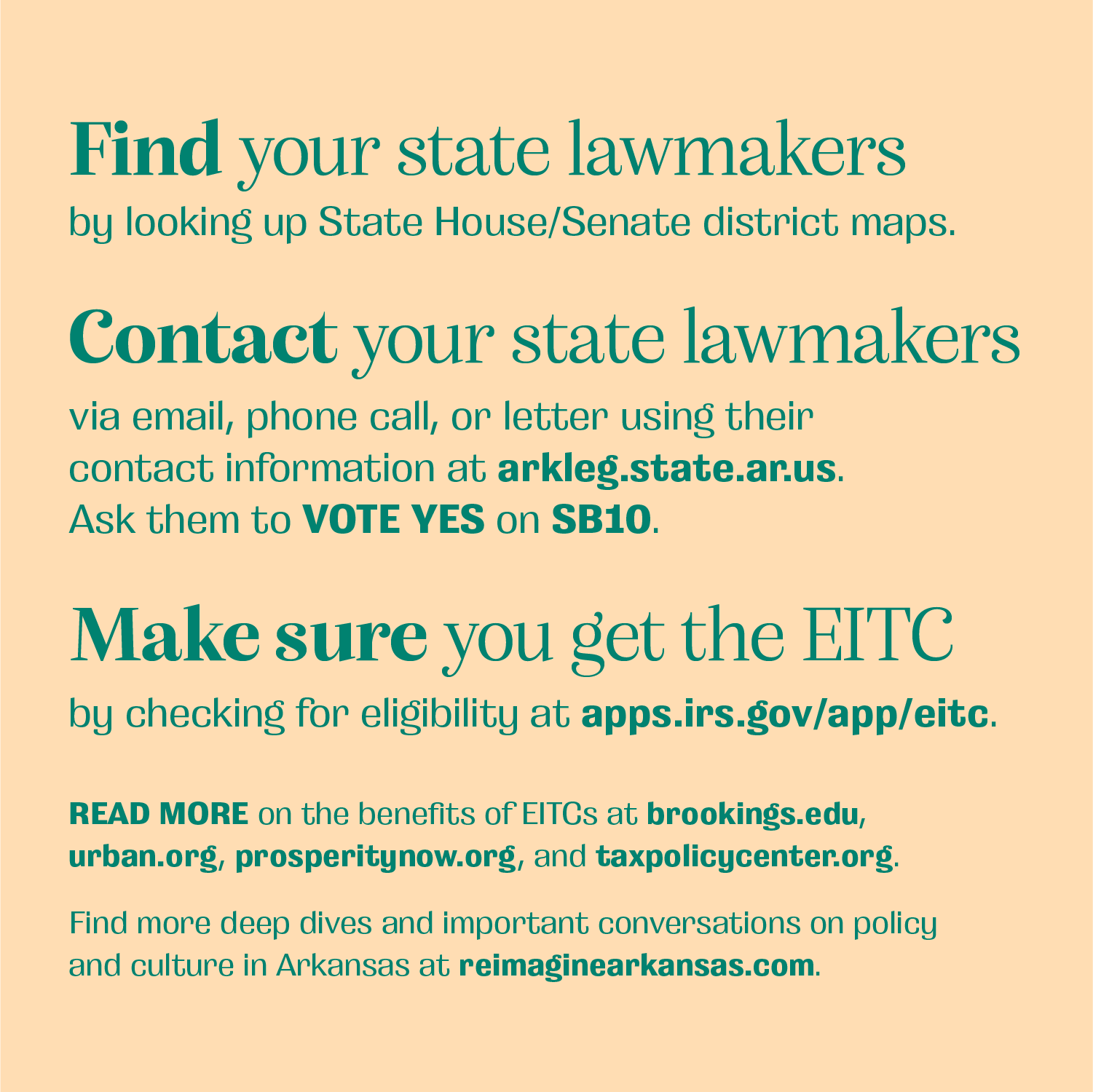

Find your Arkansas State Senate district here.

Find your State House district here.

Find your lawmakers’ contact information here.

Find out if you qualify for the federal EITC here.

Find your lawmakers’ contact information here.

Find out if you qualify for the federal EITC here.

You can read more on the benefits of EITCs here:

+ The EITC explained in 74 seconds

+ Five ways the EITC benefits families, communities, and the country

+ The Earned Income Tax Credit and community economic stability

+ Upward mobility and state EITCs

+ The EITC and minimum wage work together to reduce poverty and raise incomes

+ The EITC explained in 74 seconds

+ Five ways the EITC benefits families, communities, and the country

+ The Earned Income Tax Credit and community economic stability

+ Upward mobility and state EITCs

+ The EITC and minimum wage work together to reduce poverty and raise incomes

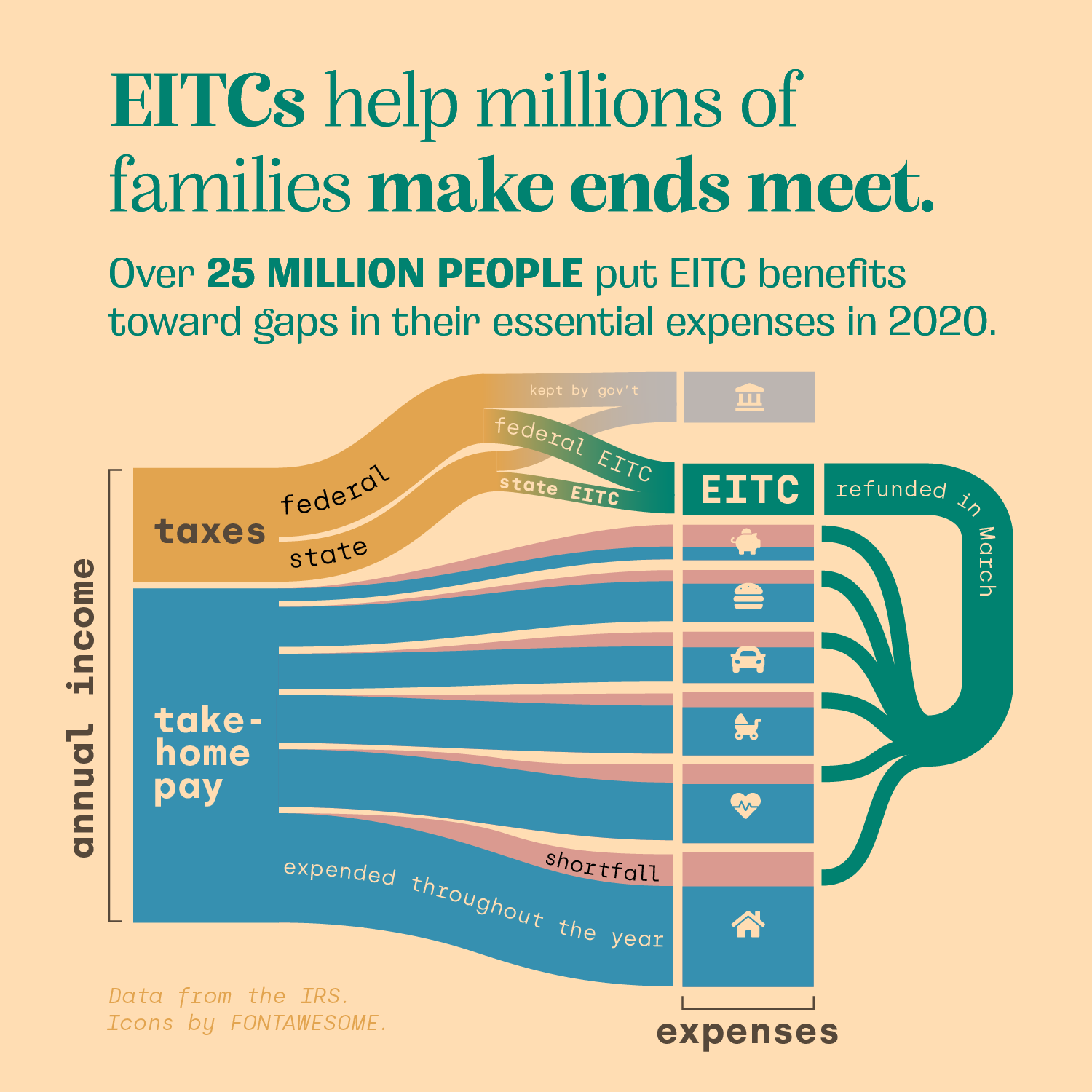

Before I started on this project with Reimagine Arkansas, I knew very little about EITCs and assumed they didn’t do much — but the EITC’s name is deceptively mundane compared to its impact. EITCs are one of the largest anti-poverty programs in the United States; they lift an estimated 6 million people (more than half of them children) out of poverty every year.

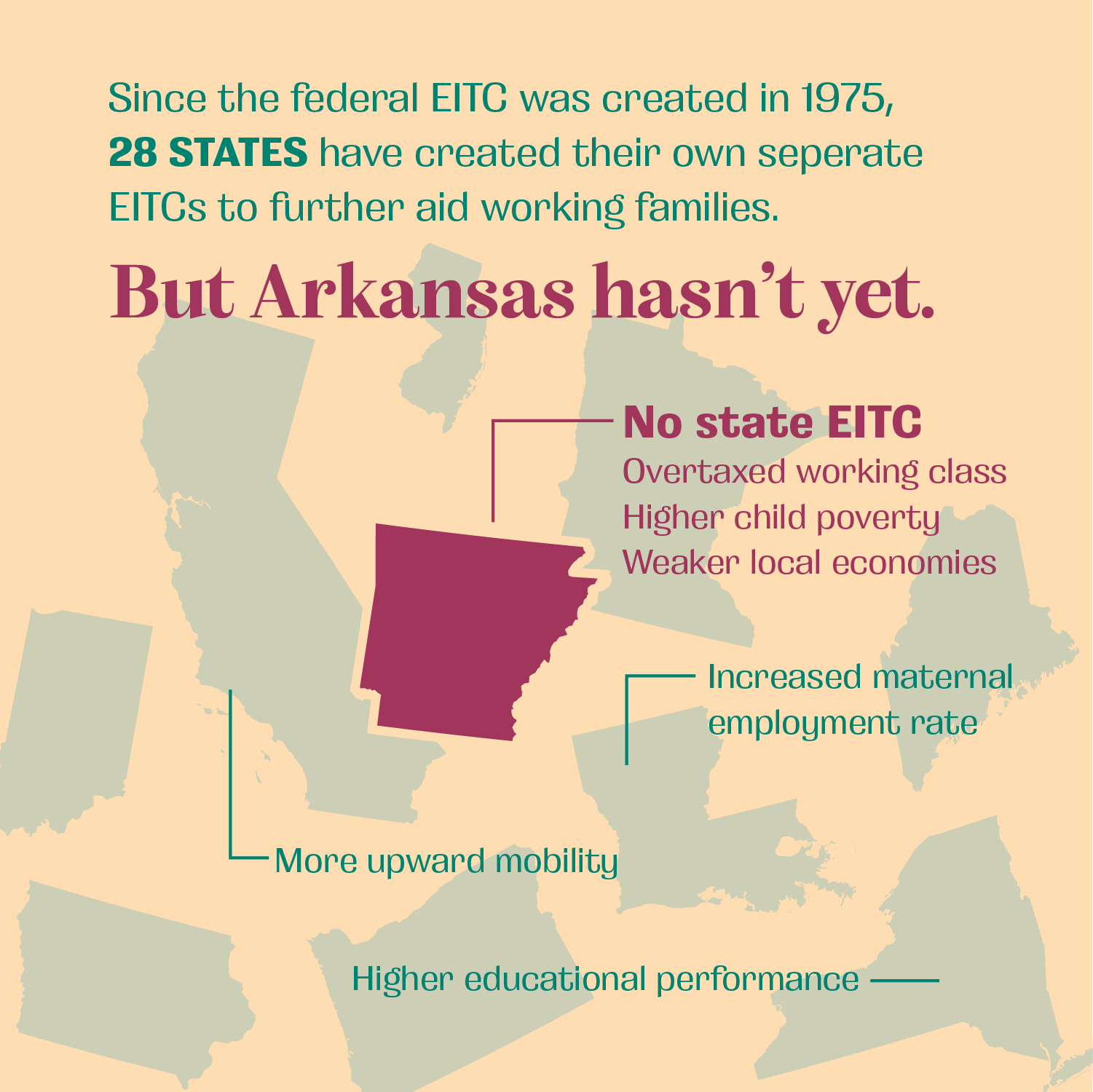

The federal EITC is given to families based on their size and income, and the credit is refundable, meaning it can exceed the amount of taxes the family has paid. Thus, the largest benefits go to the families who need them most. Since the federal EITC was created in 1975, 28 states have created their own separate EITCs, typically set as a fixed percentage of the federal EITC, to further aid their working families… but Arkansas hasn’t yet.

EITC bills have stalled in the Arkansas legislature for years. In the wake of COVID-19’s economic destruction, working Arkansans need the extra money in their pockets more than ever. Nearly half of tax filers in the state make less than $22,200; they in fact spend a larger share of their income on taxes than those with the highest incomes. That’s backwards, it’s wrong, and it’s killing people.

The proposed 10% EITC could make the difference for working people on essential expenses like rent, utilities, food, healthcare, childcare, and transit. People who don’t have to use it on essentials can save the money for emergencies or begin to accumulate wealth, as so many wealthier families already can.

The legislature should pass this tax credit and then expand it over time. New Jersey boosted its EITC from 20% to 39% between 2015 and 2018, and its working families reap the benefits. States with EITCs report better health outcomes, better educational attainment, higher salaries, higher employment rates, and stronger, stabler local economies.